With the acceleration of clean energy, graphite stocks will play a key role in the production of lithium-ion batteries for electric vehicles.

Graphite is an element composed of condensed carbon atoms that is most commonly used in electrodes, batteries and refractories.

The transportation sector accounts for one-fifth of global Co2 emissions, with road transportation (cars, motorcycles, buses, and taxis) accounting for 15% (Our World Data, 2020).

Currently, the electric vehicle market accounted for approximately 13% of total vehicle sales (IEA, 2022).

As the world economy sets ambitious goals of net zero emissions by 2050, graphite stocks can be a great long term bet on the electric vehicle revolution!

Lithium-ion Battery for Electric Vehicles

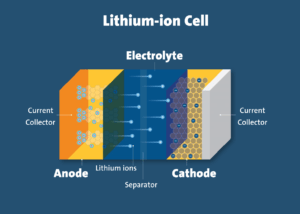

The lithium-ion battery is a key component of electric vehicles, hybrid-electric vehicles, and energy storage systems.

When you initially think of lithium-ion battery use cases, you immediately think of daily devices like cell phones, laptops and tablets.

However, lithium-ion batteries are critical infrastructure for electric vehicle production.

Lithium-ion batteries central components are the anode and cathode, with graphite being a key material in the cathode.

Graphite’s relatively low cost and high energy density can help foster a longer cycle life for lithium-ion batteries.

As electric vehicles and renewable energy storage facilities gain more popularity, graphites use cases will continue to skyrocket over the next few decades.

Below, we will present the 7 Best Graphite Stocks to buy in 2023!

- GrafTech International

- Nouveau Monde Graphite

- Entegris

- NextSource Materials

- Westwater Resources

- Graphite One

- Northern Graphite Corporation

1. GrafTech International (NYSE: EAF)

- Ticker: EAF

- Dividend Yield: 0.86%

- Market Cap: $1.19 Billion

GrafTech International is a global leader and manufacturer of graphite electrodes and petroleum coke headquartered in Brooklyn Heights, Ohio, United States.

The company is 24.87% owned by Brookfield Asset Management.

Unlike many other pre-revenue graphite companies, GrafTech has been in business for well over a century.

GrafTech’s highly engineered and technical processes have led the production of essential electrodes for arc furnace steel and metal fabrication.

The 4 step process for the production of premium petroleum coke at their Seadrift facility is one of the most sophisticated operations in the world.

With growing demand for lithium-ion batteries, petroleum coke based graphite can be a desirable alternative for electric vehicle manufacturers.

GrafTech is currently at the forefront of the manufacturing process of graphite electrodes and petroleum coke. With a large institutional ownership of over 95%, GrafTech is our top graphite stock to consider in 2023.

2. Nouveau Monde Graphite (NYSE: NMG)

- Ticker: NMG

- Dividend Yield: N/A

- Market Cap: $275 Million

Nouveau Monde Graphite is a graphite exploration company headquartered in Quebec, Canada.

The company plans to build a zero emission based operation for the acceleration and production of high grade graphite for lithium-ion batteries.

This high-purity graphite sourced at their Matawinie mine is currently in Phase 2 as a result of its most recent feasibility study.

Afterwards, the graphite is processed at their advanced battery materials plant located in Becancour, Quebec.

In June 2021, they announced a collaboration with Caterpillar, which would supply zero-emission machinery at their Matawinie mine.

With growing demand for lithium-ion batteries for the acceleration of clean energy, Nouveau Monde Graphite has the potential to be a leader in graphite production.

3. Entegris (NASDAQ: ENTG)

- Ticker: ENTG

- Dividend Yield: 0.53%

- Market Cap: $11.20 Billion

Entegris is a specialized materials process company headquartered in Billerica, Massachusetts, United States.

The company primarily provides critical materials for the fabrication process of semiconductor equipment.

Their products include filtration for the processing of gas and fluids, liquid systems and components for specialized gasses.

This includes wafer protectors and shippers that help protect semiconductor wafers from contamination.

Other products include specialized graphite, silicone carbide, and coatings.

While Entegris’ graphite is predominately used in the semiconductor industry, there are many use cases for its premium graphite in clean energy.

Including the use of their bipolar plates for the production of fuel cell technologies.

With growing demand for premium graphite solutions, Entegris is a top graphite stock to buy in 2023.

4. NextSource Materials (TSE: NEXT)

- Ticker: NEXT

- Dividend Yield: N/A

- Market Cap: $269 Million

NextSource Materials is a graphite exploration company headquartered in Toronto, Canada.

The company plans to become a vertically integrated, global supplier of critical battery materials for the world’s transition to renewable energy.

NextSource Materials has a 100% ownership interest in their Molo Graphite mine located in Southern Madagascar.

The project is currently in Phase 1 of its feasibility study, which plans to produce up to 17,000 tonnes of flake graphite concentrate per year.

This high-grade graphite concentrate transferred to their Battery Anode Facility supplies electric vehicle automotive companies.

They also have a 100% ownership interest in their ‘Green Giant’ vanadium deposit. This project is still in its very early stages, but can be critical to the production of vanadium batteries.

As the world makes clean energy an imperative, graphite demand will continue to accelerate. NextSource Materials can be at the forefront of this transition.

5. Westwater Resources (NYSE: WWR)

- Ticker: WWR

- Dividend Yield: N/A

- Market Cap: $51 Million

Westwater Resources is a minerals and graphite exploration company headquartered in Colorado, United States.

Largely focused on the production of high-purity graphite for the acceleration of renewable energy power systems.

Its projects include its Kellyton Graphite Processing Plant, COOSA Graphite, BAMA Mine, and its COOSA Vanadium project.

Westwater Resources is well capitalized for the future, with approximately $75 million in cash and zero long term debt.

With a market cap of only $51 million and growing demand for high-grade graphite, Westwater Resources is a top graphite stock to keep on your radar in 2023 and beyond.

6. Graphite One (TSXV: GPH)

- Ticker: GPH

- Dividend Yield: N/A

- Market Cap: $165 Million

Graphite One is a graphite exploration company headquartered in Vancouver, Canada.

The company is focused on developing high-purity spherical graphite for the production of lithium-ion batteries in electric vehicles.

Its Graphite Creek deposit located in Alaska US, completed its pre-feasibility study in October 2022.

Graphite One is still in its very early stages of exploration. However, in March 2023, the US Government identified Graphite One’s graphite creek deposit as one of the largest and highest grade graphite deposits in the world.

Moreover, with recognition of the US Government, Graphite One’s graphite creek deposit holds a lot of promise. Of course, the company is still speculative in nature so investors should always proceed with caution.

7. Northern Graphite Corporation (TSXV: NGC)

- Ticker: NGC.V

- Dividend Yield: N/A

- Market Cap: $58.89 Million

Northern Graphite Corporation is a minerals and graphite exploration company headquartered in Ottawa, Canada.

Focused on the production of high-purity graphite, their goal is to lead the advancement of lithium-ion battery technologies for electric vehicles.

Its projects include its Lac Des Iles Mine, Okanjande Deposit, South Okak Ni/Cu/Co Project, and its 100% owned Bissett Creek project.

Northern Graphite One is leading the charge for graphite production to meet the increasing demand of lithium-ion batteries. However, the company currently carries a lot of debt on its balance sheet relative to its cash on hand.

If you’re looking for better graphite stocks, then you might want to consider the other 6 best graphite stocks above for 2023.

Best Graphite Stocks: Final Takeaway

In almost every electric vehicle, there is a lithium-ion battery. The lithium-ion battery is predominantly made of two cells; anode and cathode.

Some of the key materials used in the production of lithium-ion batteries include; graphite, lithium, aluminum, nickel, cobalt, manganese, copper, and steel.

Graphite is the most critical material in the anode cell for the lithium-ion battery. It accounts for approximately 28% of the total weight in the anode cell.

With growing demand for electric vehicles, graphite stocks will continue to garner more attention as the global economy transitions to net-zero emissions.

Disclosure: The author holds no position mentioned in this article. Freedom Stocks has a disclosure policy.