Highlights:

- US Mar Consumer Prices Increase 8.5% From Year Earlier; Reaching a New 40-Year High.

- US Mar Consumer Prices +1.2%; Consensus +1.1%.

- US Mar CPI Ex-Food & Energy +0.3%; Consensus +0.5%.

- US Mar CPI Energy Prices +11.0%; Food Prices +1%.

U.S. inflation accelerated to 8.5% in March, reaching a new 40-Year High. Inflation rose across all items, as higher food and energy prices passed onto consumers.

Central bankers find themselves in a difficult position, as core CPI remains well above their target range. Inflation and measures of core inflation have continued to rise, despite the Fed touting that inflation was ‘’transitory.’’

The Federal Reserve will now be forced to act more aggressively. They’re expected to raise interest rates by 75 basis points in May, and begin reducing their balance sheet. Overall, consumers continue to lose trust in the Federal Government, who’s easy money policies during the pandemic ballooned the assets of the wealthy.

The macro picture in the global economy looks extremely bleak. Over the next 12-18 months, we will begin to see the effects that higher interest rates have on global growth.

Investors are still concerned about supply chain bottlenecks, expected to last well into 2023. Furthermore, Inflation outpacing wage growth is also a great concern for U.S. workers.

According to the Economic Policy Institute, nominal year-over-year wage growth for all non-farm employees was 5.6%. During this same period, inflation rose 8.5% year-over-year hitting a four decade high.

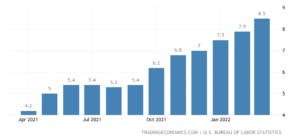

U.S. CPI Hits Four-Decade High

Source: Trading Economics

This is the fastest year-over-year increase since 1982, in wake of the Russia/Ukraine War and higher energy prices.

During Fed Chairman Powell’s last testimony before Congress, he mentioned that the Federal Reserve cannot ‘’predict inflation expectations with utmost certainty.’’ This should be alarming for the average consumer, as inflation has spilled over to nearly every area of the economy.

Some economists believe that inflation has peaked, and will begin to cool down over the coming months. However, the rate at which inflation comes down may be slower than what the market is expecting.

Key Takeaway

Supply chain constraints still remain an issue, and pose a risk to global growth forecasts. This may contribute to prolonged elevation of food and energy prices. With CPI now at its highest level in 40-years, the inversion of the yield-curve, higher interest rates, and elevated commodity prices, the U.S. economy could be heading into a period of slower economic growth.