The U.S. debt ceiling plays a critical role in the country’s fiscal management and economic stability.

If the United States were to default on their debt obligations, this will be the first time in its history threatening its status as the world reserve currency.

Although the future is unclear, make no mistake that this aftermath would trigger a larger liquidity crisis across the global financial markets sparking a much anticipated global recession.

In this article, we will delve into the significance of the U.S. debt ceiling and it’s history, the necessity for Congress to raise it, the potential economic impacts of failing to do so, and an examination of the current national debt.

The Establishment of the Debt Ceiling and the Second Liberty Bond Act of 1917

The establishment of the u.s. debt ceiling and the passage of the Second Liberty Bond Act in 1917 marked significant milestones in the United States’ fiscal history.

These measures were introduced during a time of war and played crucial roles in financing the country’s participation in World War I.

The concept of a debt ceiling was first introduced with the passage of the Second Liberty Bond Act in 1917.

The Act authorized the issuance of government bonds to finance the United States’ involvement in World War I.

The Second Liberty Bond Act of 1917 – Key Provisions:

- War Finance Corporation: The Act established the War Finance Corporation, a government agency tasked with facilitating the issuance and sale of war bonds.

- Maturity and Interest Rates: The Act authorized the issuance of bonds with varying maturities and interest rates.

- Public Campaigns: The Act supported extensive public campaigns to promote the purchase of war bonds.

While the Second Liberty Bond Act did not set a specific debt limit, it laid the groundwork for the evolution of the debt ceiling concept in the United States.

Over time, Congress developed a formalized debt ceiling, which became a statutory limit on the amount of money the federal government can borrow to finance its operations.

The debt ceiling has often become a subject of political debate and controversy.

This has become more apparent as policymakers navigate the delicate balance between government spending and fiscal responsibility.

1. Why Congress Must Raise the Debt Ceiling

Congress must periodically raise the debt ceiling to accommodate the government’s increasing financial needs.

Failure to do so can have severe consequences for the U.S. economy and global financial markets.

Here are several reasons why Congress must take action NOW:

- Honouring Existing Obligations: The U.S. government has numerous financial obligations, including paying social Security benefits, government employee salaries, and interest on outstanding debt.

- Maintaining the Full Faith and Credit of the United States: The U.S. dollar is the world’s reserve currency, and U.S. Treasury securities are considered safe havens for investors. Defaulting on debt obligations could erode the faith and creditworthiness of the United States, leading to higher borrowing costs, reduced foreign investment, and negative consequences for the economy.

- Economic Stability: Failing to raise the debt ceiling could trigger a government shutdown or disrupt essential services. This would result in reduced economic activity, job losses, and negative ripple effects throughout the economy.

2. Economic Impacts of Failing to Raise Debt Ceiling

Financial Market Turmoil:

- Failing to raise the debt ceiling would raise concerns about the government’s ability to manage its finances, leading to increased uncertainty in financial markets.

- Bond yields would likely rise, affecting interest rates on mortgages, auto loans, and credit cards.

- Stock markets may experience heightened volatility, potentially eroding investor wealth.

Weakening Dollar:

- The U.S. dollar’s status as the global reserve currency relies on the stability of the U.S. economy.

- A failure to raise the debt ceiling could lead to a weakening dollar, which would raise import costs, fuel inflation, and reduce the purchasing power of consumers.

- International trade and investment flows could also be negatively affected.

Credit Rating Downgrade:

- In the past, debates over the debt ceiling have prompted credit rating agencies to warn about a potential downgrade of the U.S. government’s credit rating.

- U.S. debt securities are considered the safest and one of the most liquid assets in the global financial markets.

- A downgrade would increase borrowing costs, making it more expensive for the government to finance its debt, ultimately burdening taxpayers.

3. The Total National Debt

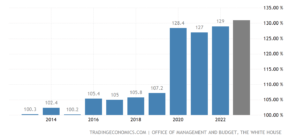

U.S. Debt to GDP Ratio: 129%

As of May 2023, the U.S. national debt stood at around $31.79 trillion.

It is important to note that this number is subject to change due to ongoing economic conditions and fiscal policies.

The national debt represents the cumulative amount of money the U.S. government has borrowed over the years to finance budget deficits.

While the national debt continues to grow, it is essential to distinguish between the debt itself and the debt-to-GDP ratio.

The debt-to-GDP ratio, which compares the national debt to the country’s economic output, provides a more meaningful measure of a nation’s ability to service its debt.

Addressing the National Debt

Addressing the national debt requires a comprehensive and balanced approach.

It involves a combination of measures such as controlling government spending and increasing revenue through taxation or economic growth.

Furthermore, other measurements include implementing structural reforms to entitlement programs like Social Security and Medicare.

Reducing the national debt is a complex task that requires careful consideration of its potential economic and social impacts.

Abrupt and drastic measures could harm economic growth and financial stability.

However, ignoring the issue entirely could lead to even greater challenges in the future.

The current administration is in a difficult position, as the U.S. economy battles with high inflation, slowing economic growth and a regional banking crisis.

U.S. Debt Ceiling: Will they Default for the First Time?

A U.S. government default on its debt obligations would have catastrophic consequences for the U.S. economy and global financial markets.

Avoiding a government default is crucial for maintaining the economic stability and creditworthiness of the U.S. economy.

While talks continue on the U.S. debt ceiling, the likeliness of the U.S. economy defaulting on its debt obligations is very low.

However, if the Republicans and Democrats are able to come to an agreement, there should be a wider discussion on the U.S. economy’s trajectory and their lack of fiscal discipline.

Congress must first undress the underlying issues of the debt and spending itself, before the U.S. economy enters into a debt spiral scenario.