Highlights:

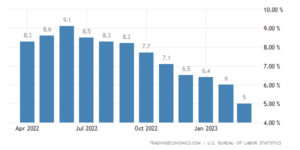

- US Mar Consumer Prices Increase 5.0% From Year Earlier; It’s Lowest Level In Two Years.

- US Mar Consumer Prices +0.1%.

- US Mar Shelter Prices +0.6%.

- US Mar CPI Ex-Food & Energy +0.4%.

U.S. inflation rate rose 5.0% in March, its slowest pace in more than two years. This is on the back of falling energy, shelter and food prices.

The shelter index was the largest contributor of the monthly increase, rising 0.6%.

After a tumultuous year in 2022 of high food and energy prices, the economy is showing signs that inflation has peaked.

The Federal Reserve was in a difficult position last year, as they reacted late on inflation. This caused inflation to soar to its highest level in 40 years back in June 2022.

Jerome Powell was under fire, as he most famously quoted in April 2021 that, ‘’inflation is transitory’’.

This resulted in central bankers being significantly behind the curve, fostering soaring inflation in the United States.

At the end of 2021, the Fed Chairman Jerome Powell and his colleagues would drop their transitory stance on inflation.

Exactly this time last year, Inflation rose to 8.5% in March 2022. This led to the Federal Reserve raising interest rates by 50 bps in May, and another 75 bps in June and July.

The Federal Reserve’s u-turn caused extremely volatile, decimating the equity and housing markets.

The labor market added 236,000 jobs in March 2023, showing signs that the market is cooling off with the unemployment rate down to 3.5%.

U.S. CPI Hits Lowest Level In Two Years

Although inflation is continuing to fall, investors are still battling with a slowing economy and higher interest rates.

On Tuesday, April 11th, the IMF raised concerns on the banking crisis and the outlook for the global economy.

They expect economic growth to slow to 2.8% in 2023, down from 3.2% in 2022.

The market is not just battling high inflation.

It is also digesting the fallout of regional banks, higher interests, supply chain constraints, geopolitical concerns in China and Taiwan, and Russia’s war in Ukraine.

U.S. Inflation: Final Takeaway

Despite the U.S. inflation rate cooling to 5.0% in March, inflation still remains high.

The Federal Reserve cannot back down on its inflation fight now, as its 2% objective is pivotal to achieve maximum employment and price stability.

Investors are betting that the Federal Reserve will raise interest rates by 25 bps at the next FOMC meeting on May 3rd.

With growing concerns of slowing global growth, and higher interest rates, the economy might be in for a difficult road ahead.