Finding the right graphene stocks can be a difficult endeavour, as there are a lot of small players in the industry.

Graphene is a material that has been making waves in the technology and manufacturing sectors for its incredible properties.

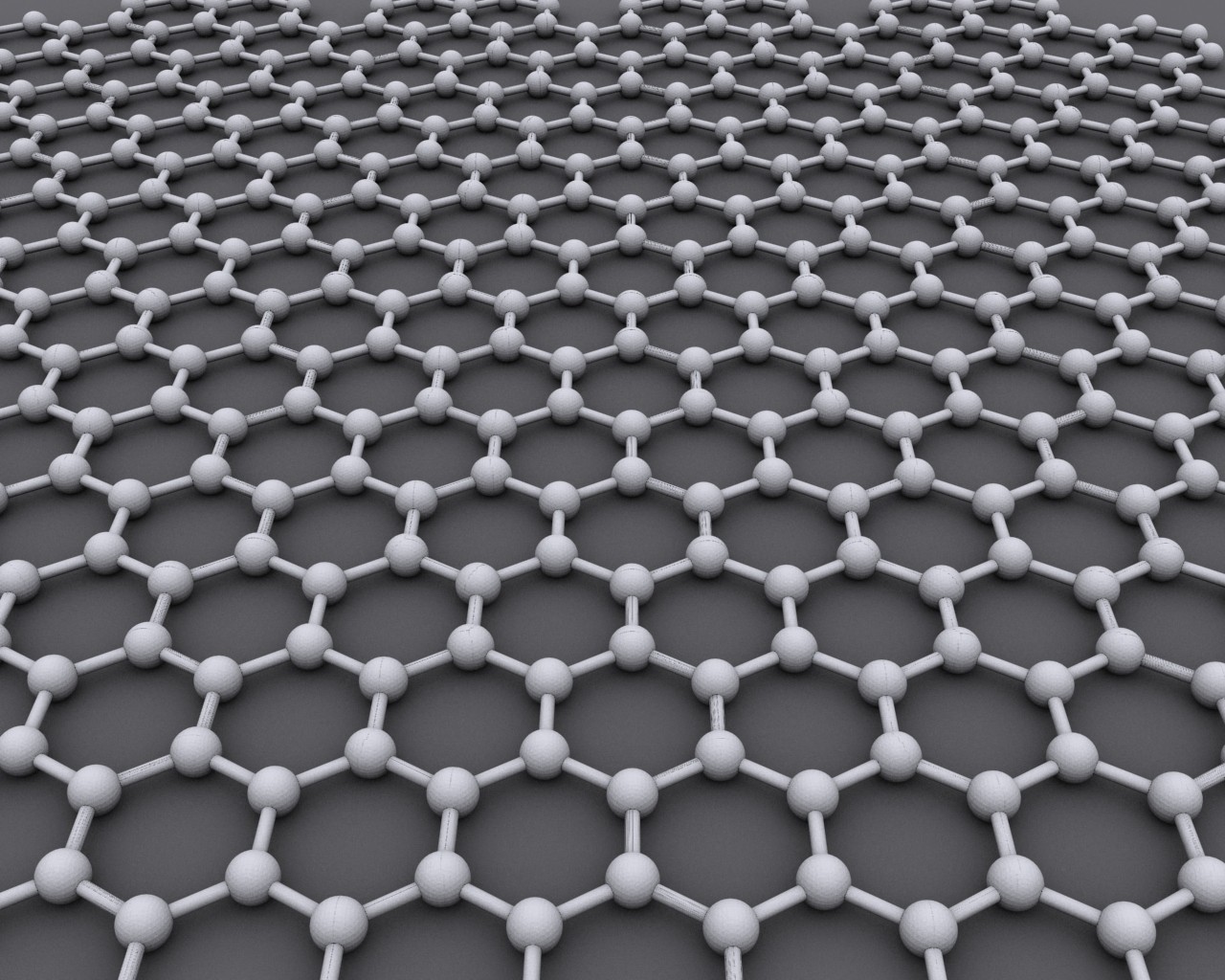

It is a single layer of carbon atoms arranged in a hexagonal lattice structure, and it is incredibly strong, lightweight, and conductive.

Its unique properties make it an ideal material for use in a variety of industries, from electronics to aerospace.

According to some estimates, the global graphene market last valued at $175.9 Million in 2022, will grow at a CAGR of 46.6% between 2023 and 2030 (Grand View Research, 2022).

Before delving into the stocks themselves, it is important to understand the difference between graphene and graphite.

While both materials are made of carbon, they have different structures and properties.

Graphite is a layered material made up of stacked sheets of graphene, whereas graphene is a single layer of carbon atoms.

Graphite can be used as a lubricant and in the manufacturing of pencils, while graphene has a wide range of applications, from energy storage to biomedical devices.

Below, we will present the 5 Best Graphene Stocks to Watch in 2023!

5 Graphene Stocks to Watch in 2023

1. NanoXplore (TSE: GRA.TO)

- Ticker: GRA.TO

- Dividend Yield: N/A

- Market Cap: $517.60 Million

NanoXplore is a US-based company that specializes in the development and production of graphene-based materials for use in a variety of industries, including energy storage, electronics, and aerospace.

With an annual capacity of approximately 4,000 metric tons, they are one of the world’s largest manufacturers of graphene powder based solutions.

You can find the company’s graphene-enhanced anode materials in lithium-ion batteries, which are becoming increasingly important for energy storage solutions.

Their goal is to bring sustainable graphene solutions to their customers through a variety of different applications.

2. G6 Materials (TSXV: GGG.V)

- Ticker: GGG.V

- Dividend Yield: N/A

- Market Cap: $4.09 Million

G6 Materials is a Canadian company that specializes in the production of high-quality graphene for use in a variety of applications, including energy storage, composites, and plastics.

The company’s graphene-enhanced plastics are stronger and more lightweight than traditional plastics, making them ideal for use in the automotive and aerospace industries.

Their products include conductive epoxies, R&D Materials, and high performance composites. Some of their customers include leading Ivey League universities, NASA and various Fortune 500 companies.

With a market capitalization of less than $5 Million, G6 Materials is extremely speculative and risky. Therefore, investors should proceed with caution.

3. NextSource Materials (TSE: NEXT.TO)

- Ticker: NEXT.TO

- Dividend Yield: N/A

- Market Cap: $255.27 Million

NextSource Materials is a mining company that operates primarily in Madagascar and is focused on the exploration and production of graphite.

While graphite is not the same as graphene, it is a key raw material used in the production of graphene.

NextSource Materials has a 100% ownership interest in their Molo Graphite mine located in Southern Madagascar.

They also have a 100% ownership interest in their ‘Green Giant’ vanadium deposit. This project is still in its very early stages, but can be critical to the production of vanadium batteries.

The company is also investing in the development of new, innovative technologies for the production of graphene, which could further improve the efficiency and scalability of graphene production.

4. Zentek (TSXV: ZEN.V)

![]()

- Ticker: ZEN.V

- Dividend Yield: N/A

- Market Cap: $216.76 Million

Zentek is a Canadian company that specializes in the development and production of graphene-based materials primarily for the healthcare industry.

The company’s flagship product is its Graphene Oxide, which has a range of applications, including water purification, energy storage, and biomedical devices.

In addition, Zentek commercialized its proprietary technology platform ZenGuard for coated masks. It has been proven to remove 98.9% of bacteria and 97.8% or more of preventative coverage of viruses.

As the global demand for graphene-based materials continues to grow, Zentek is well-positioned to capitalize on this trend over the next decade.

5. Graphene Manufacturing Group (TSXV: GMG.V)

- Ticker: GMG.V

- Dividend Yield: N/A

- Market Cap: $153.78 Million

Graphene Manufacturing Group is a Canadian company that specializes in the production of graphene and graphene-based materials for a variety of industries.

The company’s proprietary production process uses a patented plasma reactor technology, which allows for the efficient and scalable production of high-quality graphene.

GMG’s graphene products have a wide range of applications, including energy storage, electronics, HVAC, and advanced materials.

The company has also been investing in research and development to expand its product portfolio and further drive innovation in the graphene industry.

Graphene Stocks: Should You Buy in 2023?

Investing in the growing graphene industry can be a promising opportunity for investors.

However, as with any investment, it is important to consider the risks involved.

Some potential risks in the graphene industry include high production costs, limited scalability, and competition from established players in related industries.

Additionally, the industry is still in its early stages, and there is a degree of uncertainty around how quickly and to what extent the market will grow.

It is important for investors to conduct thorough research and analysis before making any investment decisions.

Investors who are willing to take on the risks involved and who have a long-term investment horizon may find investing in graphene stocks to be a worthwhile opportunity in 2023.

Disclosure: The author holds no position mentioned in this article. Freedom Stocks has a disclosure policy.